operating cash flow ratio ideal

For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time. A good operating cash flow margin is typically above 50.

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

The formula to calculate the ratio is as follows.

. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations. Below is the cash conversion ratio formula. Example of Cash Returns on Asset Ratio.

This means that the companys investors are willing to pay 5 for every dollar of. This is because it shows a better ability to cover current liabilities using the money generated in the same period. Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth.

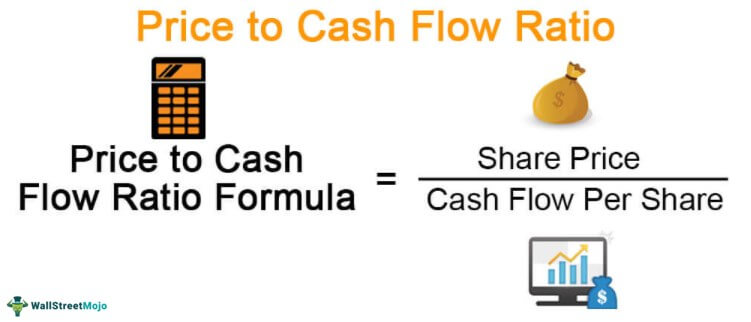

Cash Flow Per Share Operating Cash Flow Preferred Dividends Common Shares Outstanding. However the best use of calculating your operating cash flow to sales ratio is to compare it. Lets consider the example of an automaker with the following financials.

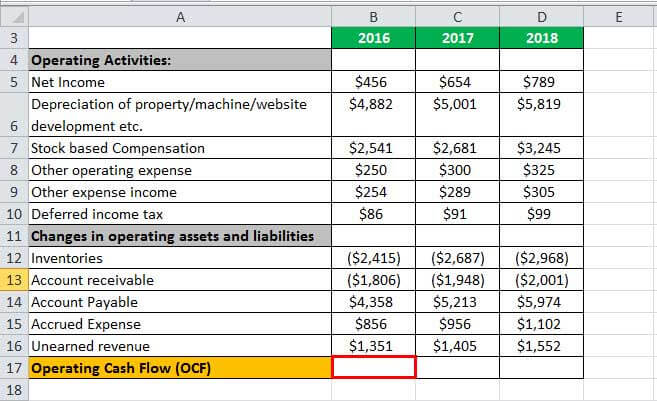

Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000 To arrive at the operating cash flow margin this number is divided by. Once cash flow is determined the next step is dividing it by the net profit. Low cash flow from operations ratio ie.

Cash Flow-to-Debt Ratio. So a ratio of 1 above is within the desirable range. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations.

There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with. Operating cash flow ratio This ratio calculates how much cash a business makes as a result of sales. The company thus has a PCF ratio of 5 or 5x 10 share price OCF per share of 2.

Thus investors and analysts typically prefer higher operating cash flow ratios. A cash flow margin ratio of 60 is very good indicating that Company A has a. The ideal ratio is close to one.

The CAPEX to Operating Cash Ratio assesses how much of a companys cash flow from operations is being devoted to capital expenditure. Cash Flow from Operations refers to the cash flow that the business generates through its operating activities. Well while theres no one-size-fits-all ratio that your business should be aiming for mainly because there are significant variations between industries a higher cash flow margin is usually better.

That is the profit after interest tax and amortization. The CAPEX to Operating Cash Ratio is a financial risk ratio that. This ratio can help gauge a companys liquidity in.

In general terms an operating cash flow to sales ratio of 10 to 55 is considered good with a higher number indicating a better ability to convert sales directly into cash. Operating cash flow ratio CFO Current liabilities. Cash Flow from Operations CFO divided by Current Liabilities CL or.

Operating cash flow Net cash from operations Current liabilities Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make. A ratio smaller than 10 means that your business spends more than it makes from operations. This may signal a need for more capital.

It means that the automaker generates a cash flow of 5 on every 1 of its assets. Cash returns on assets cash flow from operations Total assets. The operating cash flow ratio is a measure of a companys liquidity.

Below 1 indicates that firms current liabilities are not covered by the cash generated from its operations. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. A higher ratio is more desirable.

This ratio is a type of coverage ratio. Such investments entail engaging in capital-intensive projects such as expanding a production facility launching a new product line or restructuring a division. In this case we want Cash Flow from Operations or Free Cash Flow which is equal to operating cash flow minus capital expenditures.

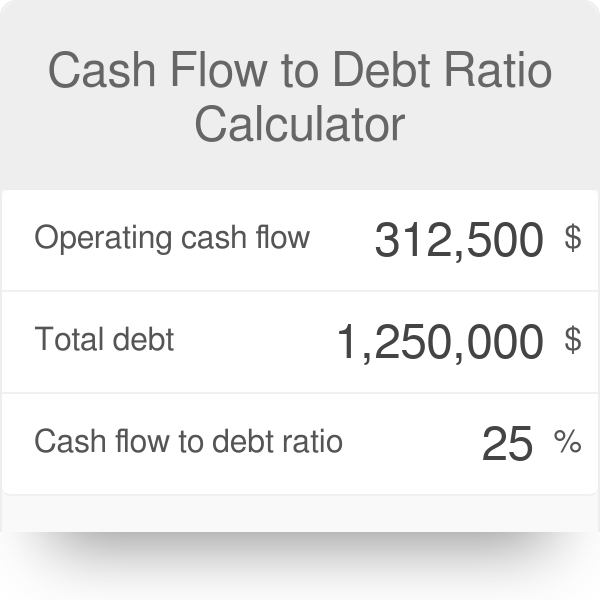

How can we calculate the Operating Cash to Debt Ratio. 500000 100000. Thus in this case the operating cash flow to sales ratio must be 75 or close.

This number can be. If it is higher the company generates more cash than it needs to pay off current liabilities. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt.

Cash Returns on Asset Ratio 5. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities.

Operating Cash Flow Efinancemanagement Com

Cash Conversion Ratio Financial Edge

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Operating Cash Flow Formula Calculation With Examples

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Per Share Formula Example How To Calculate

Cash Flow To Debt Ratio Calculator

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Calculator

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Operating Cash Flow Ratio Definition Formula Example

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)